VM/IM Repapering: Learning the lessons from ‘Big Bang’

(Last updated: )

What did we learn?

1 March 2017 – deadline day for ‘big bang’ – has come and gone. We all breathed a sigh of relief. Or did we? Regulators recognised the fact that firms would not be compliant and, in general, counselled the industry to ‘do your best to get it done by 1 September’. “Foaming the runway” was how the CFTC described it – not a great choice of words for an industry desperately trying to avoid a crash landing.

By 3 March, average CSA execution rates across the industry were reported to be 40.72% (a sizeable jump from the 8% of 22 February!) with only 10.45% of documents having been loaded into bank reference data systems. So VM repapering continues and IM repapering is looming. Why were execution rates so low? What can we learn from the period up to ‘big bang’?

The process is key

A flexible, cradle-to-grave process is critical for success. The elements of this process should include initial data scrubbing, first draft generation, playbook construction and maintenance, negotiation, authority checking, execution and data capture. Don’t get overly fixated on headline cost and don’t allow yourself to become dazzled by technology. Any service which does not include all of these elements risks creating additional burden for ‘business as usual’ documentation teams – all of which translates into greater cost. Moreover, inflexibility in any component part serves only to increase cost yet further. A refusal/inability to negotiate on account of the fact that ‘the computer says no’ will not wash with many counterparties. It won’t win you any friends, is not good for long-term relationship building and doesn’t save time. The result is simply more toing and froing during the negotiation phase, leading to reduced operational efficiency and lower execution rates. In this respect, big reputations don’t guarantee great service. Be prepared to negotiate and be realistic about your position from the outset.

The lawyers could do better

As a lawyer, I know that lawyers love to lawyer. Unfortunately, the old joke about putting two lawyers in a room and emerging with three opinions was all too prevalent prior to ‘big bang’. In truth, the new VM CSA was over-engineered from the outset. It included a number of clauses which, whilst neat from a legal point of view, were largely unsupported by the current systems of market participants (“Interest Adjustment” and “Credit Support Offsets” being just two examples). Inclusion of provisions of this type simply detracted from the task at hand – getting as many CSAs executed and over the line as possible by 1 March so as to allow trading to continue. Unfortunately, too many lawyers contributed to making the task even more difficult, departing from the ISDA VM CSA template – the only thing that market participants could point to as in any way capturing an industry standard position. In large part, all this did was slow down still further the negotiation process, resulting in even lower rates of execution. It did little to address the fundamental risks or commercial requirements of the industry.

Allied to a legal process which too often got bogged down, there were also still plenty of examples of disconnects between the positions documented by Legal Departments and the ability of Operations Departments to actually deliver. For example, whilst it’s legally fine to exclude legacy trades from the WGMR margining requirements, you should really only do this if Ops can differentiate between two ostensibly identical trades solely by reference to the date on which they were executed. Obvious, you’d have thought – but a bear trap into which a number fell. Put simply, we weren’t talking enough.

It’s not how many you sign, it’s how many you can trade on

‘Big bang’ showed that, in general, legal reference data capture systems aren’t good. In many cases, getting decent quality data output so as to allow the amendment process to begin was difficult enough. However, the mass upload of data from WGMR-compliant CSAs showed just how fragile some of these systems really are. Executing a compliant CSA means nothing if the data from that CSA is not captured and fed efficiently into downstream risk and trading systems. The performance of legal agreement databases should have been tested and timed prior to ‘big bang’ so that the process of data input could be properly resourced. Unfortunately, it wasn’t. Output should also have been thoroughly checked before entering a live environment. Unfortunately, in too many cases, this was an afterthought.

Regulators can’t be relied upon to ‘blink first’

At the eleventh hour, in order to facilitate continued market access for all, regulators did provide a degree of comfort to the industry about their ability to trade on non-compliant documentation. However, differing interpretations and implementations of regulatory guidance proved to be a source of confusion in themselves. More importantly, it has not really alleviated any of the pressure and certainly does not address the root cause of the problem. Put simply, hope is not a strategy. As an industry we need to become better at executing what, in truth, were relatively simple amendments, albeit done on large scale.

Protocols have an elastic limit

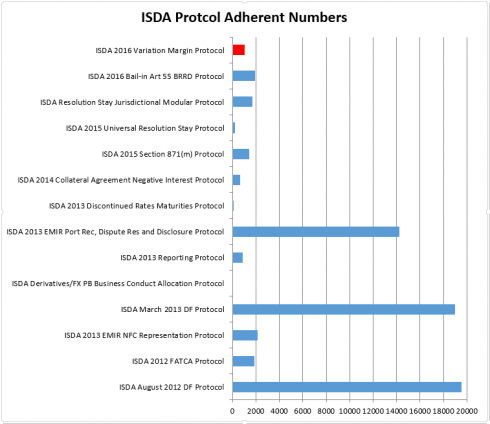

We have seen a sharp decrease in protocol adherence rates since the heydays of the Dodd-Frank Protocols and the EMIR Port Rec, Dispute Res and Disclosure Protocol in 2013. Since that time, as this chart highlights, not one protocol has managed to gather over 2,000 adherents. Why is this?

One key contributing factor is undoubtedly the fact that protocols are becoming increasingly difficult to understand and manage. The buy-side – who, after all, are the set of market participants which ISDA most wants to attract to protocols – find this particularly off-putting.

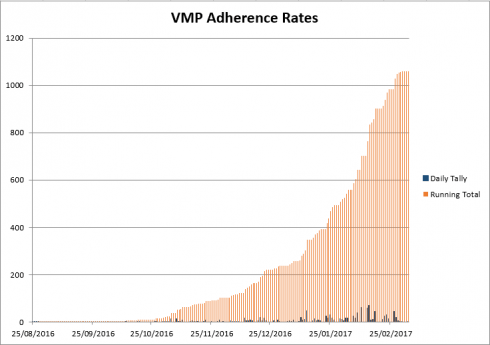

The ISDA 2016 Variation Margin Protocol (VMP) took complexity to a whole new level. Despite this it was still not flexible enough for all, meaning that many of those that did adhere still had to amend the terms of that adherence bilaterally so as to allow them both to make their desired elections. In a number of cases, even firms which were originally happy to use the VMP ended up abandoning their preference for VMP adherence altogether and falling-back to bilateral negotiations. Largely as a result of this complexity and inflexibility, the VMP was essentially shunned by the buy-side. Despite the looming 1 March deadline, the chart below confirms that the exponential growth in VMP adherence rates promised by ISDA never materialised (since 1 March it seems to have fallen off a cliff). The situation calls into question ISDA’s current strategy over protocol use. When your protocol becomes more valued as a source of template clauses in order to facilitate bilateral negotiations than it does as a protocol in its own right it is time to wonder whether resources could more usefully be invested elsewhere.

Applying the lessons of ‘big bang’

So how do we implement these lessons? What things should we do differently in relation to remaining VM repapering or future IM repapering? Here are a few things to consider…

Start earlier

It is certainly true that, in many jurisdictions, WGMR regulations were finalised very late in the piece. This undoubtedly hampered the compliance effort. However, that excuse won’t hold for IM repapering and, in any event, firms could have done a lot more by way of preparation before the starting gun was fired on VM compliance in January 2017. Relatively simple housekeeping activities – most of which do not rely on counterparties – can reap huge benefits. Preliminary data cleansing and aggregation is one obvious example. Documenting negotiation positions within a ‘playbook’ is another (even if those positions need to be refined in light of subsequent negotiations).

Improve Coordination

A coordinated effort is essential if VM and IM repapering is to proceed as efficiently as possible and trading is to avoid disruption. A process map – a graphic representation of the inputs, actions and outputs of each step in the process by which CSA data is acquired, processed and consumed within an organisation – is a key tool in ensuring this. If available and done properly, it will highlight all relevant stakeholders in the process, providing a ready-made list of all of those who must be consulted. Once identified, thought must be given to the requirements of each stakeholder, the constraints under which they operate and the systems upon which they rely. A plan must be created to accommodate each.

Think more about the process you will adopt

The weakness of, and wastage resulting from, inflexible processes was brought into sharp relief during ‘big bang’ VM negotiations. If ‘Phase 1’ and ‘Phase 1.5’ showed anything, it was that IM repapering is far more complex than VM negotiation. As such, clear objectives supported by a flexible process that can handle the degree of complexity IM repapering brings is a ‘must’. This process must also be sufficiently well defined to allow it to be tracked for the purpose of producing the MI which both stakeholders and senior management need. This will require a significant degree of prior planning and scenario testing. If you are seeking external assistance, consider whether document specialists may be better and cheaper than outside counsel – it’s a different skill set (the management of documentation versus the provision of legal advice). Of course, as Von Moltke noted, no plan survives first contact with the enemy. So you need a ‘Plan B’ and the ability to adapt at speed.

Technology should be part of the process, but the process must not become a slave to the technology. Quite the opposite, don’t be afraid to ‘do it the old way’ and pick up the telephone to your counterparty. Despite the bespoke changes introduced by some firms, both the VM and IM CSAs are still relatively standardised documents and so – with a proactive approach – lend themselves to rapid negotiation and execution. However, if high completion rates are your goal it is advisable to ‘go with the flow’. In other words, avoid coming up with a unique solution to the repapering problem, as some did during ‘big bang’. If you do, you will only be swimming against the tide, making your own life more difficult.

Think about how you are going to build it into BAU processes

Consideration needs to be given early in the piece as to how VM and IM negotiation will be subsumed back into ‘business as usual’ processes. If ‘big bang’ repapering was outsourced to external consultants, how is that knowledge to be repatriated into the organisation? Is repatriation even an option given existing levels of resource? If not, what other options are open to you?

How we can help

At DRS we specialise in helping to optimise the way in which you manage documentation – increasing operational efficiency in contract negotiation, amendment and analysis. By 3 March, our average execution rates were over 78% across 7 clients (both sell-side and buy-side) and several thousand CSAs, with the highest being over 95%. This compares to a reported industry average of 40.72%. We did it by focusing on the process.

If the management of contracts is an activity which is necessary, but not core, to your business, give some consideration to the benefits of outsourcing – reduced cost, no capital outlay, optimisation of human capital, scalability, operational resilience and price transparency to name but a few. If you’d like to know more, drop me an email at michael.beaton@drsllp.com.

Contact Us