SBS Standalone protocol launched

(Last updated: )

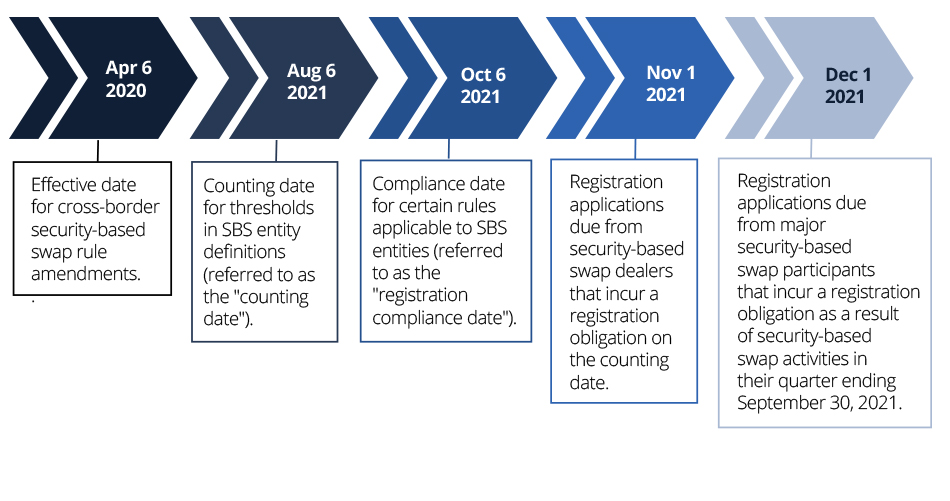

ISDA yesterday launched the 2021 Security-based Swaps (SBS) Protocol, aiming to facilitate compliance with the long if not eagerly-awaited SEC SBS rules which largely come into force from 6 October 2021. The Protocol sits alongside the ISDA 2021 SBS Top-Up Protocol published on 15 March 2021. While the top-up protocol amends agreements made by adherents to the August 2012 and March 2013 Dodd-Frank protocols, incorporating earlier elections; today’s SBS protocol is standalone and does not require earlier adherence. In this regard, it will be of for those parties that chose to bilaterally incorporate CFTC rules, or who wish to make different elections in respect of SBS transactions. The Top-Up Protocol is open to both ISDA members and non-members, subject to the usual $500 fee per entity, with bulk discounts available. Adherence is via submission of an adherence letter and the exchange of matching questionnaires, which will be available on the ISDA Amend platform in due course.

Dodd-Frank Title VII grants SEC jurisdiction over SBS and SBS market participants, requiring the SEC to formulate, finalise and adopt rules to regulate the market. SBS generally include swaps based on a single security or loan, swaps based on a narrow-based security index, and single-name credit default swaps.

The charitable view is that the SEC took a different view from its sister (though not a close family) agency the CFTC- preferring finality over immediacy. The SEC rules cover the same broad areas as the CFTC 2015 Swaps rules- registration, recordkeeping and reporting, risk mitigation, capital, margin and segregation, transaction reporting and external business conduct. The SEC rules are more than an echo of the CFTC and Prudential regulations (which are virtually identical), but they are by no means an exact mirror. Bearing in mind that the SEC rules “only” apply to non-bank and broker-dealer SBS dealers and major market participants, a brief refresh of the differences between the SEC June 2019 final rules and the 2012 CFTC regulations in respect of margining highlights the gap between the SEC and the WGMR global (more or less) consensus:

- there is no AANA- the SEC rules do not have the concept of a notional portfolio threshold. In theory a single transaction may trigger compliance. Although single transaction exposure is unlikely- because the SEC rules do have the same $50m exposure threshold and $500,000 MTA as the CFTC/PR

- the SEC rules exempt financial intermediaries from the collection of IM (VM must still be exchanged), specifically: Banks, Foreign Banks, SBSDs, SDs, Broker-dealers, Foreign Broker-dealers, FCMs

- the SEC rules in respect of collateral eligibility for VM and IM are more flexible, allowing for any form of cash, a major foreign currency, securities, money market instruments and gold that meet fairly vague liquidity requirements- a “ready market” and “readily transferable”

- the SEC Rules require that the collateral be subject to a netting and collateral agreement with the counterparty, but unlike the CFTC/PR do not require specific margin documentation in the form of an eligible master netting agreement

- Although allowing for substituted compliance via the CFTC rules, the SEC standardised collateral haircuts are more granular e.g. a range of four haircuts of 0% – 1% for US Govt. securities < 1yr., while the CFTC/PR require a single haircut of 0.5%

The long lead-in from final rule adoption to coming into force should have allowed ample time for familiarisation with and implementation of the SBS entity rules. Given competing calls on scarce operational and legal resource, timely preparation has been far from universal. There is no phase-in, compliance is triggered by multiple registration dates. Once registered, an SBS entity will be expected to comply with the vast majority of a complex ruleset, including documentation requirements or the need to establish substituted compliance. Although, it should be noted that, again uniquely, the SEC rules do not require documentation in respect of IM until two months after breaching the $50m exposure threshold.