ISDA Consultation – The results are in…

(Last updated: )

In May 2019, ISDA launched two consultations: one addressing adjustments to fallback rates if IBORs are permanently discontinued, and another to address the pre-cessation of LIBOR and other IBORs.

The operationally imminent cessation of LIBOR can hardly be classified as breaking news. The light shone by the 2008 financial crash fatally exposed the benchmark’s fragility, and the CEO of the FCA, Andrew Bailey decided to withdraw regulatory life support for the reference rate in July 2017. His increasingly strident pronouncements that firms need to accept the demise of LIBOR and begin their transition towards alternate risk-free rates (RFRs) before the end of 2021 have failed to gain traction.

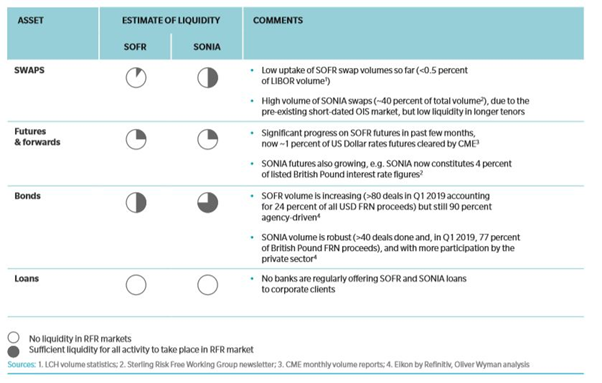

Even now, firms are seemingly asleep at the wheel, failing to adopt RFRs and bid adieu to LIBOR. Below is useful chart as part of a longer report, showing that although SOFR and SONIA liquidity is steadily increasing, LIBOR remains the dominant rate in the market, especially for loans, futures and forwards. It is worth pointing out that SONIA has had more than a head start when compared to other RFRs, given that it has been the established overnight index swap (OIS) rate in the UK since 1997.

The second consultation was a response to the request by the Financial Stability Board’s Official Sector Steering Group (FSB OSSG) to seek an understanding of what events should trigger a move to a spread-adjusted fallback rate for LIBOR. An example of a pre-cessation trigger could be ‘a public statement by the regulatory supervisor for the administrator of (the benchmark) announcing that (the benchmark) is no longer representative’. In the UK, this could occur if enough panel banks stop using LIBOR, in which case the FCA would declare LIBOR to be ‘unrepresentative’ of the broader market.

FCA’s Head of Markets Policy, Edwin Schooling Latter points out that participants will then have to consider the negative ramifications of continuing to use that rate, noting that there is powerful logic to avoiding contractual reliance on a benchmark that is no longer representative of an underlying market. If a pre-cessation trigger has adopted the ISDA 2006 Definitions, then the triggered contract would move to the fallback even if LIBOR (or the other IBORs) were still being published. The pre-cessation trigger(s) would also apply to new derivatives being traded under the standard ISDA 2006 Definitions, and to legacy derivatives between participants that chose to bilaterally amend or adhere to the inevitably forthcoming Protocol.

Given that the implementation of these triggers and fallback rates will determine the essential features of various trading contracts, ISDA’s consultation will be imperative to see whether there is a consensus in the market.

As in all politics, consensus is not easy to find. ISDA collated the responses of 89 entities across the industry regarding whether, and how, to implement a pre-cessation trigger. The results of the consultation were divided into three categories, with no clear coherence about a preferred option:

- Those who felt that that it would be better to add a ‘pre-cessation trigger’ to the permanent cessation triggers that have been written into the amendments of the 2006 ISDA Definitions and related protocol.

- Those who support the use of the pre-cessation trigger as long as it met their other requirements, or if the trigger was implemented with optionality and flexibility.

- Those who opposed the pre-cessation trigger altogether

ISDA is due to release a full summary in September 2019, but it is easy to see some benefits and drawbacks to each option mentioned above.

Option 1: Adding a pre-cessation trigger

- Advantages:

- Perhaps the biggest advantage of option one is that it offers a streamlined approach across non-cleared and cleared derivatives that would mitigate the basis risk that hedging relationships across the derivative contracts were not offsetting one another.

- LCH and CME have declared their support for a uniform approach of how cleared derivatives operate with a pre-cessation trigger if the 2006 ISDA Definitions were to include such a trigger. At the same time, they have also said that they will consider the pre-cessation triggers even if ISDA Definitions do not use them. They have clearly communicated to ISDA and other regulators that a public announcement that declares LIBOR unrepresentative would be a relevant factor in their assessment of whether the benchmark was fit for purpose, adding that they will use their discretion to use an alternative reference rate.

- OSSG appears to have received feedback supporting an approach that creates a common representativeness trigger across all contract types. They agreed that this option could be beneficial, as long as the regulations had a strong underpinning.

- Disadvantages

- By making all participants prescribe to the same pre-cessation triggers there is a chance that all firms are forced to make unnecessarily complicated operational changes. Even though the LIBOR is declared ‘unrepresentative’, it might still be the best option in the interim period.

- Fallback triggers are not supposed to be the primary mechanism for transition. Instead, firms are encouraged to switch to RFRs as soon as possible so they do not need to rely on the triggers. Having them in place could create a false sense of security in the sense that firms might rely on it.

Option 2: Making it optional to use the pre-cessation triggers

- Advantages:

- Chatham Financial has released a summary of their response to the consultation explaining why they support this option. In their chosen scenario, LIBOR and IBOR remained a more functional option to RFRs, even though LIBOR had been declared unrepresentative by regulatory authorities. In this context, keeping fallback options ‘flexible’ and ‘optional’ might be the best solution. Firms could still negotiate individual terms and switch to the alternative rate in the case LIBOR downgrades by a significant amount. This method leaves that choice up to the firm, compelling them to adapt LIBOR’s cessation to their business needs, but ensuring that they comply overall with its eventual demise.

- We can see the advantage of this option in a more general context with derivatives and hedging, for example if a cash product is tied to a derivative. If the cash products include the triggers, and the benchmark changes in the event of a pre-cessation, then the market participants may benefit from implementing the same trigger for the derivatives that hedge those cash products. Conversely, if the new cash products do not have the triggers and fallbacks then participants may prefer not to include them in the derivatives that hedge those products. The level of flexibility within this option allows the participant to tailor the trigger to what would work best for them.

- Disadvantages

- The potential impact of inconsistent fallback terms and triggers could lead to large losses if the different rates adopted by parties do not offset each other. This could happen if certain legacy derivatives sign up to the ISDA protocol and therefore adopt the pre-cessation triggers while others do not. The difference in the rates being used (unrepresentative LIBOR vs. adjusted spread) could lead to large risks for non-cleared derivatives if market participants do not consider the full impact of their ‘flexibility’.

- The burden of negotiating with the other party to find a mutually beneficial alternative to the pre-cessation triggers could lead to additional troubles.

Option 3: Those who opposed the pre-cessation trigger

- Advantages:

- Given that the fallback will not match the relevant IBOR exactly, there will be some losses incurred if the triggers are implemented for all new derivative contracts. The trigger should not put pressure on market participants to change their reference rate before they are ready. All firms should now be aware that LIBOR will be faded out, and it could be argued that the trigger does not add anything to this apart from extra pressure.

- In the case of some legacy contracts, changing contractual references to LIBOR might not be practicable. For example, even though some cash products have pre-cessation triggers in place, legacy cash products do not have them. The process of changing the contractual terms of legacy cash products can be quite difficult, and so hardwired approach might create a mismatched result.

- Disadvantages

- Without a trigger for the event in the ISDA definitions, market participants could find themselves forced to continue using LIBOR in legacy contracts with a severely disrupted market or have to find alternate rates that might not match their other swaps.

ISDA have stated that the proposed solution will seek to ‘avoid unnecessary complication and optionality, or anything that could jeopardise broad market adoption of the permanent cessation fallbacks’. Having been alerted to LIBOR’s chronic lack of representation, it might be reasonable to think that market participants would not want to use an unrepresentative rate, but a pre-cessation switch to a fallback runs the risk of impeding liquidity growth in risk-free rates; with the partial exception of Sonia, the risk-free rates are an unknown devil. The pre-cessation continuing publication of LIBOR will clearly, but perhaps unhelpfully, highlight the comparative financial wisdom of electing to include the trigger. It is clear that LIBOR has a date with death by end 2021, the regulatory gap between pre-and actual cessation is likely to be vanishingly small in operational terms, market participants should focus on the cessation half of pre-cessation.

Contact Us