CDS, GBP IRS go to the MAT

(Last updated: )

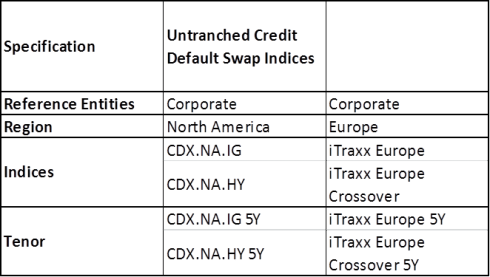

The CFTC announced yesterday that it has certified Tradeweb Markets’ Made Available to Trade (MAT) submission. This is the first determination to include credit default swaps and also triggers the trade execution requirements in respect of GBP IRS and some additional maturities for USD and EUR IRS. The new requirements are effective as of the 26th February 2014. The following USD and EUR denominated benchmark CDS have been mandated to trade on an SEF or DCM.

Following the recent approvals for Javelin and trueEX, it is no surprise to see MAT determinations coming (relatively) thick and fast. The broader market’s true state of readiness will become clear over the next few weeks. Now that SEF’s are here and well on their way to being compulsory, just as SEF’s act as dealer-aggregators, the race is on to create a form of SEF aggregator\consolidator, in an effort to mitigate the liquidity fragmentation caused by the first generation. However, given that the 21 currently-registered SEF’s is less than half the number previously envisaged, the need for a next-gen “uber-SEF” may not be quite so urgent.

Contact Us